How much does the average Canadian need to retire comfortably? It’s a common question, especially amid increasing financial pressures. With daily concerns often taking precedence, long-term retirement planning can easily be overlooked.

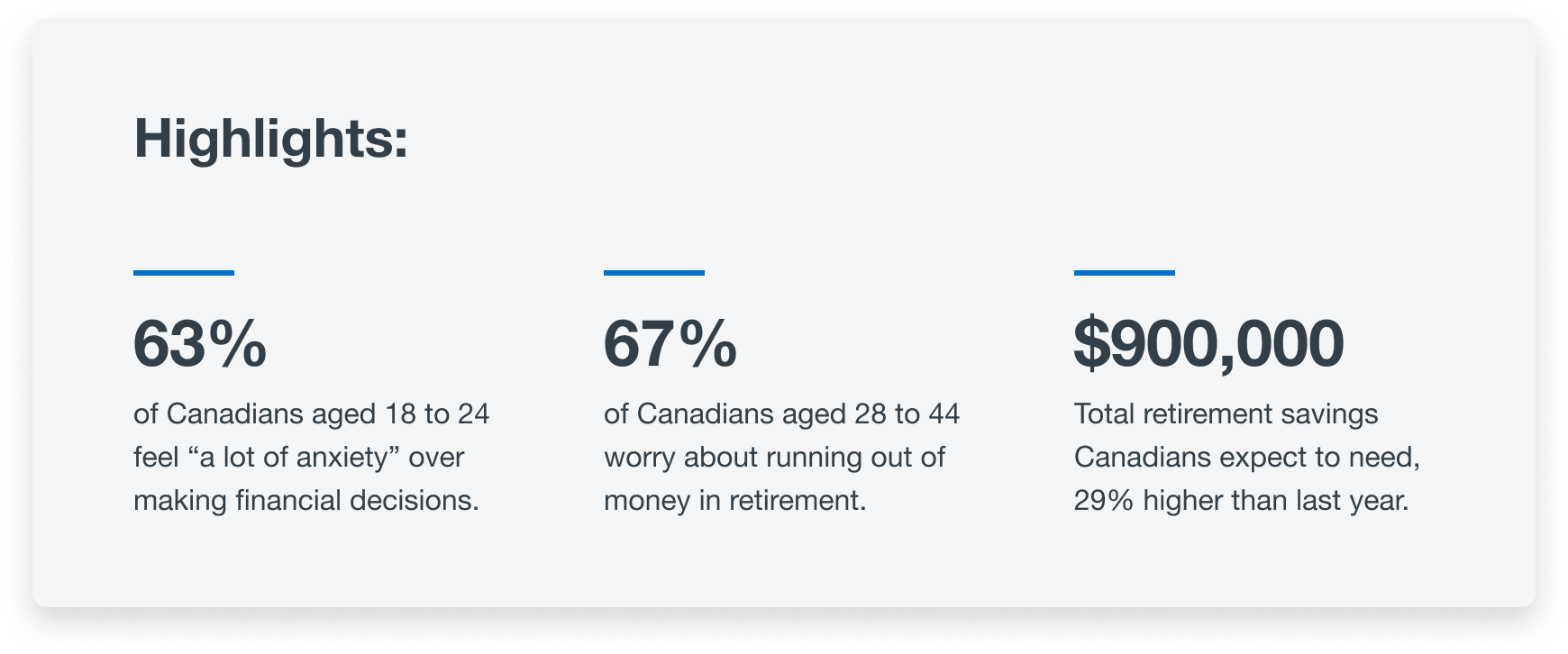

A new survey from CPP Investments, conducted for Financial Literacy Month in November, reveals 61% of Canadians fear running out of money in retirement. This anxiety is even more pronounced among adults aged 28 to 44, with 67% expressing concern, and is felt more strongly by women (66%) than men (55%). Given rising costs, longer lifespans and the increasing struggle to make ends meet, it’s no surprise that nearly six in 10 Canadians report feeling financial stress daily.

The survey highlights inflation and affordability are top concerns for many right now. Over the past year, Canadians have raised their retirement savings goal from $700,000 to $900,000 – a nearly 30% increase in just 12 months.

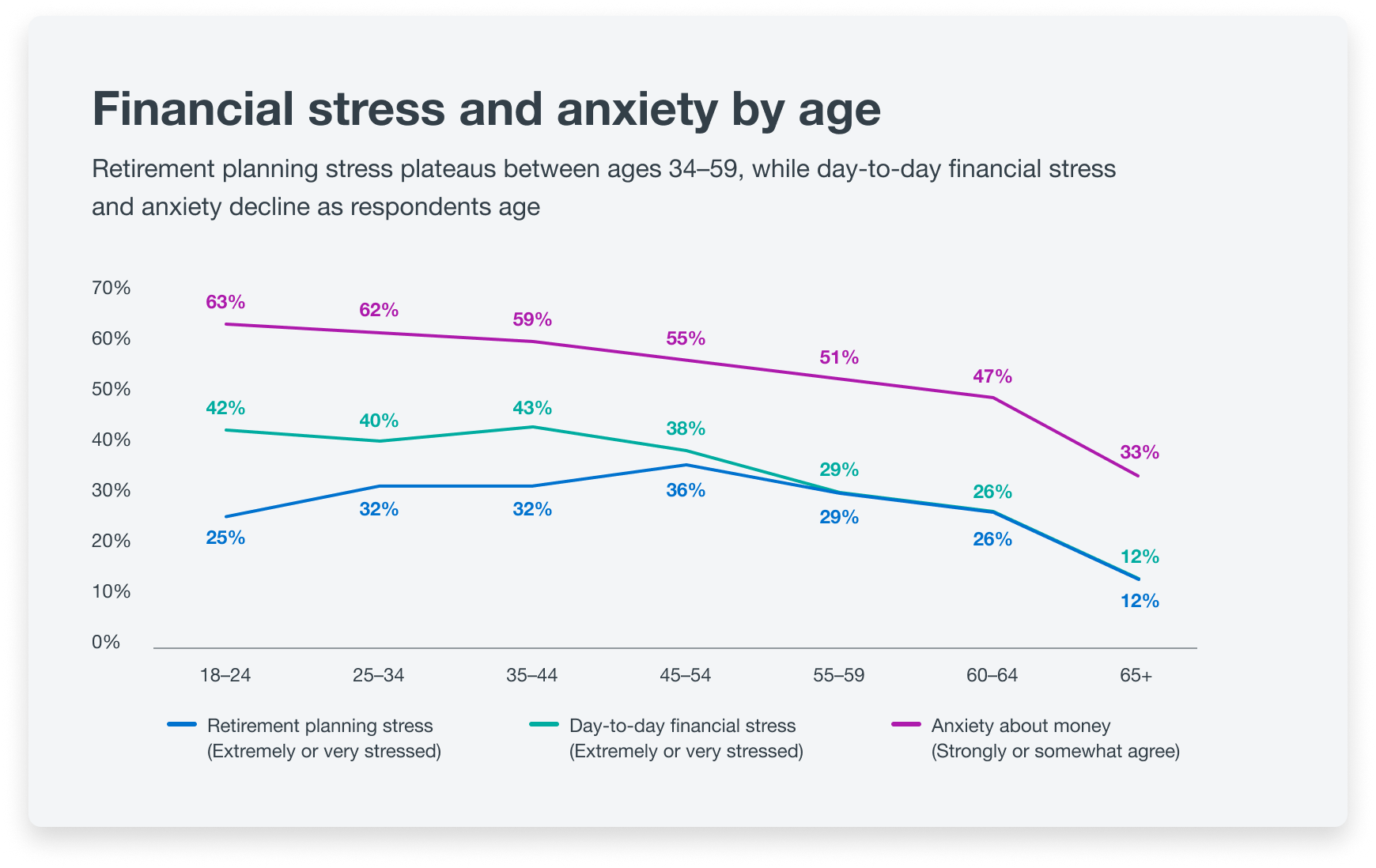

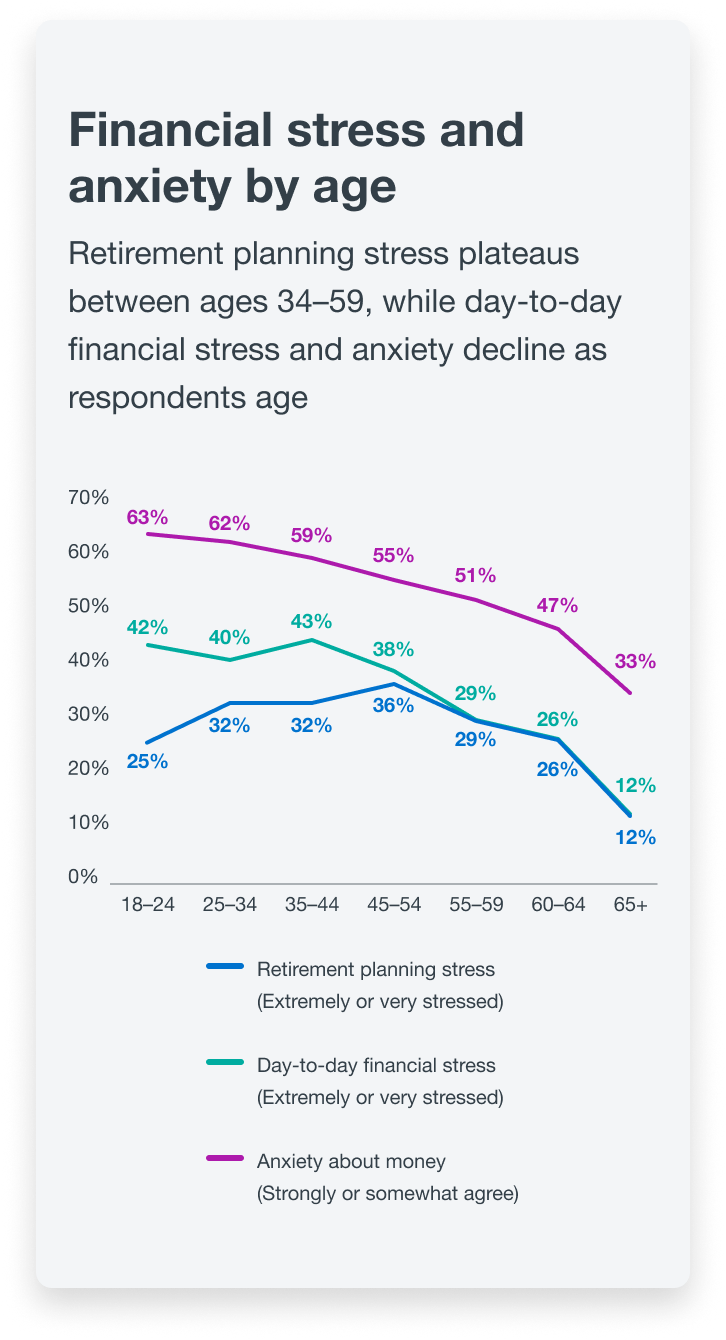

Young people are particularly stressed about their finances. According to the survey, 63% of Canadians aged 18 to 24 feel “a lot of anxiety about making the wrong decisions with my money.” This anxiety decreases with age, with only one-third of respondents aged 65 and older expressing the same concern.

“Based on our survey, running out of money in retirement is a real worry for Canadians, which is understandable given life expectancy is on the rise,” said Michel Leduc, our Senior Managing Director & Global Head of Public Affairs and Communications. “This underscores the importance of building a solid understanding of your personal finances and seeking resources to improve financial literacy to help you manage money more effectively.”

The CPP can help you get there

Saving for the future can be challenging, but financial anxiety can be eased with the confidence that comes from having a solid plan. Fortunately, more than 22 million Canadians have a base for their retirement plan through the Canada Pension Plan (CPP).

“Working Canadians are already saving for their retirement through their CPP contributions,” Leduc said. “One thing that Canadians have that protects them is that their CPP benefits are payable as long as they live and are indexed to inflation. They can take comfort in the fact that the CPP – in part through the work of CPP Investments – will be there for them and for generations to come.”

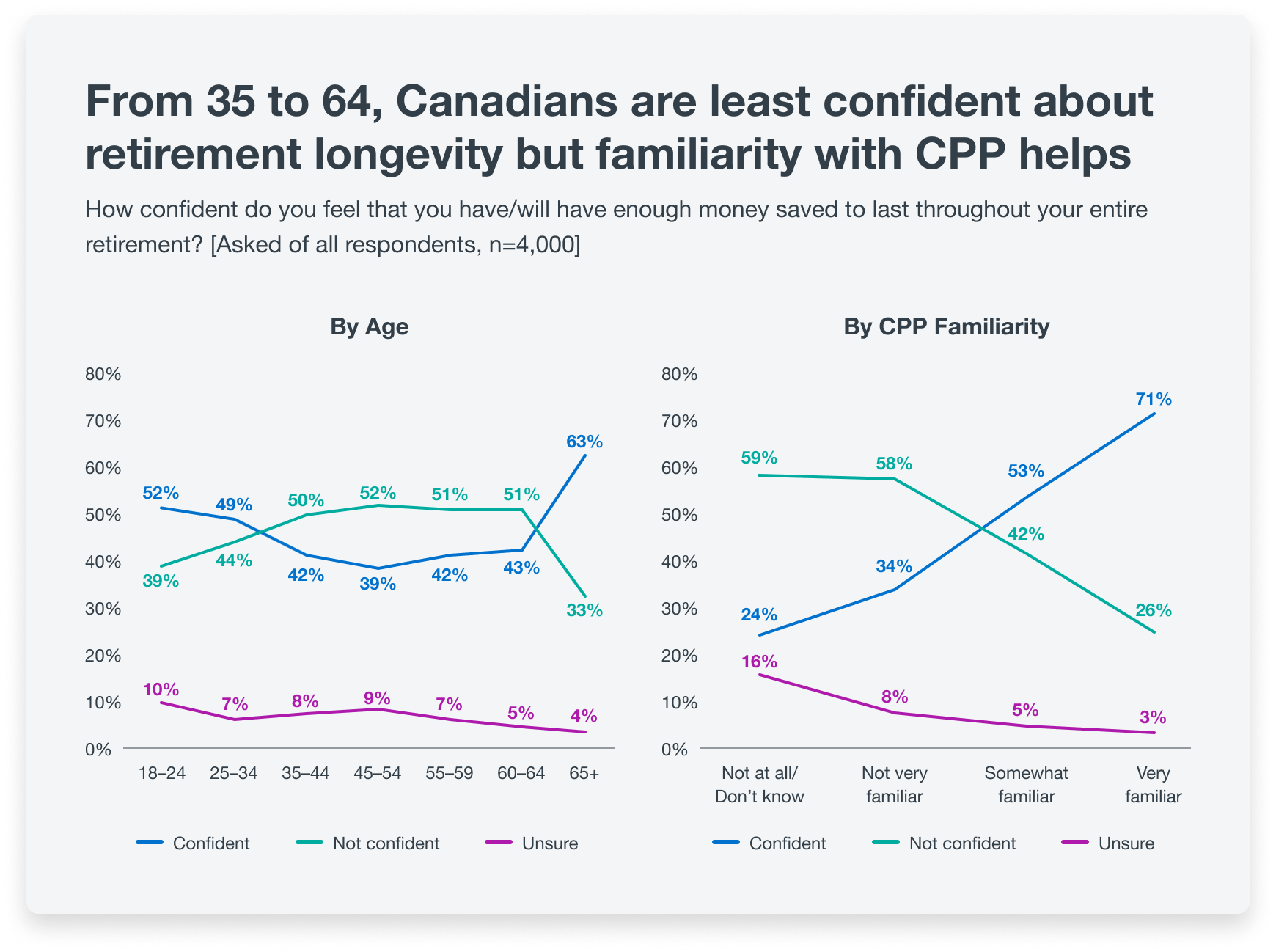

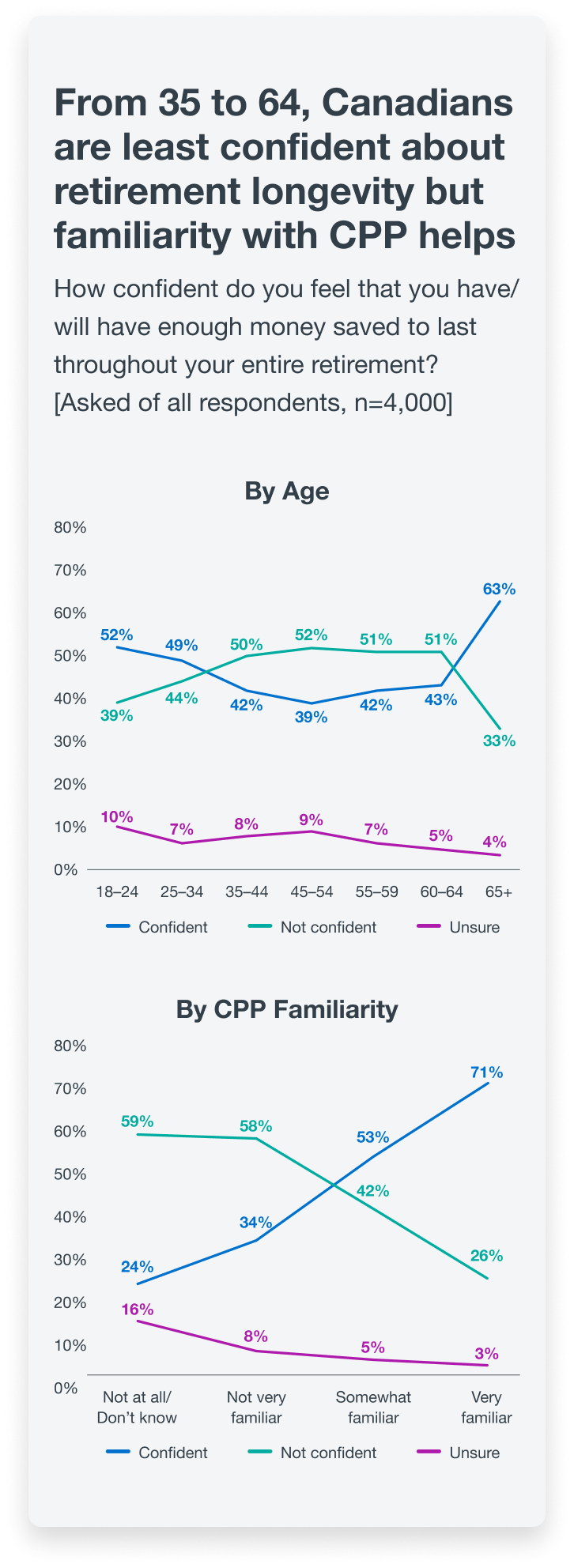

Recognizing the value of the CPP can boost confidence in having enough money for retirement. The survey shows only 24% of Canadians aged 35 to 64 who are unfamiliar with the CPP believe their savings will last throughout their retirement. In contrast, 71% of those very familiar with the CPP feel confident about their savings. This highlights the importance of understanding the value of the CPP.

The facts are reassuring. The CPP Fund, managed by CPP Investments, holds more than $675 billion in assets, making the CPP one of the world’s largest pension plans. With a 10-year annualized net return of 9.1%, after all expenses (as at September 30, 2024), CPP Investments ranks among the top-performing institutional investors globally.

As Canadians live longer, they can feel secure knowing CPP benefits will be there for them throughout retirement. The Office of the Chief Actuary of Canada’s latest report, published in December 2022, projects the CPP is financially sustainable for at least the next 75 years.

“Understanding the role played by the CPP as a reliable foundation for retirement income can help reduce financial anxiety and boost confidence to enable Canadians to pursue long-term plans.”

Michel Leduc

Senior Managing Director & Global Head of Public Affairs and Communications

“Knowing you already have a head start through the CPP can help make retirement feel more achievable and can hopefully alleviate some of the stress people have about saving for retirement,” Leduc said.

Retirement planning provides a financial roadmap for the future, and our national pension plan is one piece of the puzzle. When it’s time to retire, the CPP will be there to help.

Survey methodology: The survey was conducted by Innovative Research Group from August 1 to 7, 2024, with an online sample of 4,786 Canadians (outside of Quebec), 18 years or older, with respondents from Leger and Lucid, leading providers of online samples. The sample is weighted to a final sample size of 4,000 to ensure that its composition reflects the actual Canadian population according to Census data. This is a representative sample. However, because the online survey was not a random probability sample, a margin of error cannot be calculated. Statements about margins of sampling error do not apply to most online panels.

How much does the average Canadian need to retire comfortably? It's a common question, especially amid increasing financial pressures. With daily concerns often taking precedence, long-term retirement planning can easily be overlooked. A new survey from CPP Investments, conducted for Financial Literacy Month in November, reveals 61% of Canadians fear running out of money in retirement. This anxiety is even more pronounced among adults aged 28 to 44, with 67% expressing concern, and is felt more strongly by women (66%) than men (55%). Given rising costs, longer lifespans and the increasing struggle to make ends meet, it’s no surprise that nearly six in 10 Canadians report feeling financial stress daily. The survey highlights inflation and affordability are top concerns for many right now. Over the past year, Canadians have raised their retirement savings goal from $700,000 to $900,000 – a nearly 30% increase in just 12 months. Young people are particularly stressed about their finances. According to the survey, 63% of Canadians aged 18 to 24 feel "a lot of anxiety about making the wrong decisions with my money." This anxiety decreases with age, with only one-third of respondents aged 65 and older expressing the same concern. "Based on our survey, running out of money in retirement is a real worry for Canadians, which is understandable given life expectancy is on the rise," said Michel Leduc, our Senior Managing Director & Global Head of Public Affairs and Communications. "This underscores the importance of building a solid understanding of your personal finances and seeking resources to improve financial literacy to help you manage money more effectively." The CPP can help you get there Saving for the future can be challenging, but financial anxiety can be eased with the confidence that comes from having a solid plan. Fortunately, more than 22 million Canadians have a base for their retirement plan through the Canada Pension Plan (CPP). "Working Canadians are already saving for their retirement through their CPP contributions,” Leduc said. “One thing that Canadians have that protects them is that their CPP benefits are payable as long as they live and are indexed to inflation. They can take comfort in the fact that the CPP – in part through the work of CPP Investments – will be there for them and for generations to come." Recognizing the value of the CPP can boost confidence in having enough money for retirement. The survey shows only 24% of Canadians aged 35 to 64 who are unfamiliar with the CPP believe their savings will last throughout their retirement. In contrast, 71% of those very familiar with the CPP feel confident about their savings. This highlights the importance of understanding the value of the CPP. The facts are reassuring. The CPP Fund, managed by CPP Investments, holds more than $675 billion in assets, making the CPP one of the world’s largest pension plans. With a 10-year annualized net return of 9.1%, after all expenses (as at September 30, 2024), CPP Investments ranks among the top-performing institutional investors globally. As Canadians live longer, they can feel secure knowing CPP benefits will be there for them throughout retirement. The Office of the Chief Actuary of Canada’s latest report, published in December 2022, projects the CPP is financially sustainable for at least the next 75 years. “Understanding the role played by the CPP as a reliable foundation for retirement income can help reduce financial anxiety and boost confidence to enable Canadians to pursue long-term plans.” Michel Leduc Senior Managing Director & Global Head of Public Affairs and Communications "Knowing you already have a head start through the CPP can help make retirement feel more achievable and can hopefully alleviate some of the stress people have about saving for retirement," Leduc said. Retirement planning provides a financial roadmap for the future, and our national pension plan is one piece of the puzzle. When it’s time to retire, the CPP will be there to help. Survey methodology: The survey was conducted by Innovative Research Group from August 1 to 7, 2024, with an online sample of 4,786 Canadians (outside of Quebec), 18 years or older, with respondents from Leger and Lucid, leading providers of online samples. The sample is weighted to a final sample size of 4,000 to ensure that its composition reflects the actual Canadian population according to Census data. This is a representative sample. However, because the online survey was not a random probability sample, a margin of error cannot be calculated. Statements about margins of sampling error do not apply to most online panels. 2024 Financial Literacy Month Retirement Survey Results Learn more